How Do Global Events Affect Investment Portfolios: A Complete Insight

It is not uncommon for the world financial markets to see abnormal shifts in investment portfolios after a significant global event.

We’re barely past one such turbulent year!

2020 saw the spread of COVID-19 at an unprecedented speed, accompanied by a dramatic change in investors’ behaviour. Massive selloffs around the world led major stock indexes to hit the ground.

Then came the US presidential elections. As exit polls began predicting the victory of Joe Biden over Donald Trump, markets started to feverishly prepare themselves for another massive movement.

What does this augur for investors?

Are events like the US presidential election or natural disasters like the current pandemic conditions the only factors that can affect investors’ portfolios?

The article attempts to provide an insight on various global events that impacted/can impact the financial markets. It also lays down some final words on what investors can do to safeguard their investment portfolios.

Global events which affect investments

Global events related to the following categories have had a history of impacting investments and financial markets:

- US presidential elections

- The relative strength of the US dollar

- Geopolitical tensions

- Trade policies

- International relations

- Political scandals in countries

- Significant incidences of terrorism

- Major natural disasters or pandemics

Let’s discuss each to understand how and why they impact the “investment decision-making” process.

How do the US presidential elections affect stock markets?

If each country were a butterfly, the USA would be a very big one. A quiver of its wings will reverberate as a monumental shockwave throughout the whole world. Major events in America, such as the U.S. presidential elections, have huge implications on the stock market across the world.

Thankfully, there is 90 years worth of data to fall back on. Historical trends about stock market performance before, during, and after presidential elections can help to set expectations for wary investors.

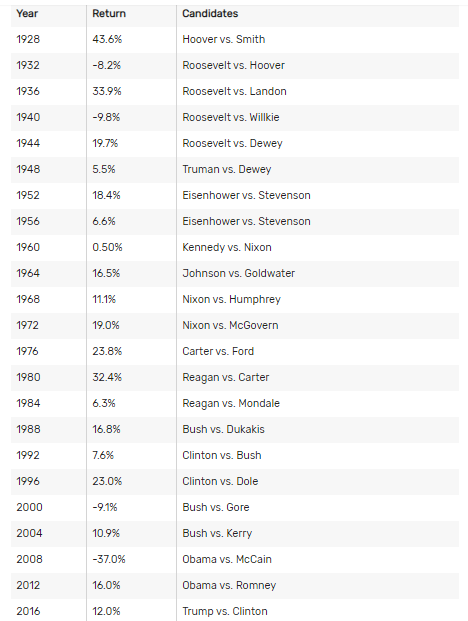

Check out the following fluctuations in S&P 500 for all election years from 1928 to 2016:

Source: Dimensional’s Matrix Book 2019

Nonetheless, history only serves as a helpful guide. The future does not promise to go by the rules.

One such example was the 2016 US presidential election. The incident serves as an example of how quickly the market can incorporate new information and end up contradicting predictions.

That being said, let us look at the pattern of market responses before, during, and after the US presidential elections.

A review of market data of the S&P 500 over the last 90 years (as provided in the picture above) also suggests that equity and bond markets are less volatile in the 12-months running up to the presidential elections.

Historical trends indicate that U.S. stocks and bonds tend to perform better during an election year compared to the year after. The case is the opposite for international equities. In these cases, returns for the year after a U.S. presidential election far exceeded those during an election year.

In terms of stocks vs bonds performance, the post-election period is usually marked with relatively lower stock market returns but slightly better bond performance.

Another noticeable factor that affects investor behavior is the party to which the presidential candidate belongs.

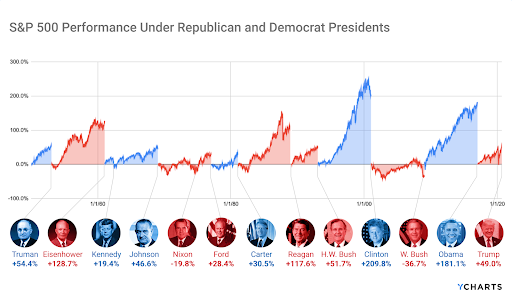

Source: RBC capital markets

According to data collected since 1900, Democrat-elected presidents have been more favourable for stocks, with the DJIA averaging 9% compared to 6% for Republican presidents.

Source: YCharts

Certain reports suggest that when a new party comes into power, the stock market gains an average of 5%. However, every time a president is re-elected, or the same party retains control, the returns average higher at 6.5%.

The reason here is that the investors already know what to expect from the same president.

Markets hate uncertainty. The election-year adds to the turbulence causing the S&P 500’s higher volatility as recorded historically.

A new president could always add to the uncertainties, such as increased regulations, higher taxes, and other policy changes, which the market perceives as anti-business.

However, a re-elected president might also give investors a major reason to start a selloff if his actions during his term had been disappointing.

Effects due to geopolitical tensions

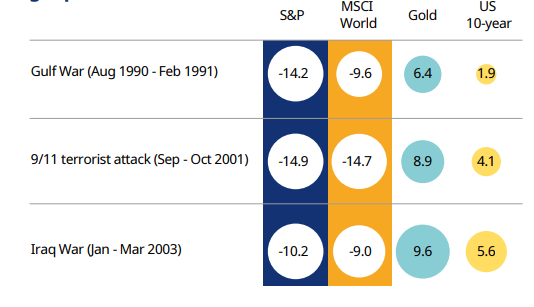

During the last few decades, significant negative market returns arose a few times. Some of these were the Gulf War (1990-1991), the Asian financial crisis (1997), the Dotcom bubble, the 9/11 terrorist attacks(2001), the Iraq war (2003), the Subprime Mortgage crisis (2008), and Brexit (2020).

Source: Thomson Datastream, Schroders Economics Group. 14 May 2019

The fastest to react to a negative event is the currency spot markets. In such scenarios, they can lose as much value in two days, as they normally do over a month. Similarly, if it is a positive geopolitical event, they react more strongly over the medium term.

This is generally detrimental for strategies that are more macro currency focused but these swift movements are beneficial for momentum and trend following based trading strategies.

On the other hand, equity markets react to both positive and negative events in a more symmetrical fashion. After an event, there are either rolling returns above or below the historical average for a period of 1 to 2 months.

Brexit is another important example to study.

The UK’s decision to exit the EU had a significant impact on the global markets. The initial shock of the announcement saw that the global stock markets wiped some $2 trillion whereas the FTSE 100 index plunged to about 9%.

The Equity markets in both UK and the US saw some repercussions with S&P 500 declining by 3.5%. The Euro Stoxx 600 declined by 7% while the Germany Dax index went down by nearly 7%. (Source: The Impact of ‘Brexit’ on the Global Financial Markets by Francisc I. Toma)

The Dotcom bubble or the Internet bubble is another example. It was caused by the internet-based companies over speculating in the late 1990s. Between 1995 to 2000, the Nasdaq composite stock market index and S&P500 index saw multiple fluctuations.

At its end in the year 2002, around $5 trillion was lost in market capitalization.

Trade policy and international relations

Trade policies made by influential countries can also cause a bull or bear run in either the local stock markets or the international exchange. The inflammatory rhetoric and trade sanctions from Trump’s administration over the past few years have caused strained international relations with multiple countries.

Consider the US-Sino trade war as an example.

All through his presidential journey, Donald Trump continually questioned and condemned China for its unfair trade policies. In 2018, his administration imposed heavy tariffs on various imports from the Chinese Markets.

A retaliation soon came from China in the form of heightened tariffs on USA products.

The tariff wars continued till mid-2019 after which the two countries agreed to repair their trade relationships. However, China failed to stick to its end of the deal due to the COVID crisis.

This caused a domino effect in affected countries and their trade partners. The impact was, therefore, felt the most by emerging markets.

As a result, global manufacturing slowed down and international stocks were affected. Markets and businesses were directly and indirectly impacted as well.

With the Biden administration taking power in 2021, geopolitics could again dominate headlines as US clashes on trade and sanctions with countries like China, Russia, and Iran.

Political scandal and turmoil within a country

Turmoil within a country can be caused by political scandals or severe unemployment, triggered by a recession-plagued economy.

The COVID-19 pandemic simply escalated matters by strangling small to large corporations. Riots and demonstrations not only prohibited business activities but caused financial damages which companies could not afford to make.

The result has been a prolonged period of uncertainty which is not favorable for investments.

Needless to say, foreign investments in such countries will be slow. Their stock performance will be impacted negatively as investors start to sell out.

There are plenty of literature pointing to the negative relationship between political instability and stock prices. Political stability reduces uncertainty and urges investors to put their funds in different investments.

Economic growth and political stability are also deeply interconnected. The uncertainty associated with an unstable political environment may reduce the pace of economic development. Additionally, it discourages both local and foreign investments from taking place.

Events like terrorist attacks (say, 9/11 attacks) might be the most damaging of all the global events, as these are often sudden and unpredictable.

The attacks were followed by a strong negative reaction from the stock markets.

The S&P 500 fell more than 14% in the first week of trading. An approximate $1.4 trillion was lost in the first five days of trading alone!

Such incidents cause an unnecessary loss of cost in terms of equipment, property, and lives. Well-intending companies also find it hard to staff operations as workers are often unwilling to live in a high-risk or dangerous location.

Similarly, country-based turmoils like the Greek Government debt crisis which happened due to excessive government spendings had serious implications. And these were not just limited to Greece but spilled over to European as well as international markets.

Effects of natural disasters on investments

Natural disasters are capable of bringing a significant financial toll on businesses- to the order of multi-million dollars. The losses could be in terms of property damage, loss of lives, and disruption to commerce.

Climate change is increasing the frequency of storms and other weather-related events.

Research done on the impact of natural disasters on investor sentiment shows that investor sentiment is less affected in developed countries such as the USA and Japan, and more in emerging economies such as India and Indonesia.

Japan is the least affected by recurring natural disasters such as earthquakes and tsunamis, as they have historically shown a fast rebound in rebuilding the affected infrastructure and townships.

What can investors do for their investment portfolios?

Historically, stock market turbulence is heightened in the months leading up to an election due to investors’ aversion to uncertainty. During such a time, it might be best to take a step back and put personal feelings about politics aside.

Giving in to political fears or expectations by making major changes to investments can be particularly damaging. Media outlets will naturally seize the opportunity to flood the channels with sensational content. At such times, it might be wise to read or watch the news with a grain of salt.

Where things are beyond one’s control, all that one can do is prepare for increased volatility and stay focussed on the larger picture.

For instance, the more conservative investors can consider spreading out their investments by putting in 20% now, 20% in another month, and so on. This may help to manage the overall volatility of one’s portfolio.

For advisers, balancing their client’s portfolio between traditional and alternative investment asset classes is the most important and wise decision, given the increasing correlation amongst the traditional asset classes during times of crisis.

Long-term healthy allocation continues to make sense, as economic cycles last longer than presidential terms.

When developed markets are volatile and uncertain, emerging markets still offer relative value and diversification to investment portfolios. The sectors that may be worth investing in at such a time are those that will benefit from trends like globalization and e-commerce.

Alternatively, one can consider sectors and companies with no US exposure. These could include domestic-oriented niches like utilities. Other examples are consumer staples, infrastructure, and technology investments.

To hedge your portfolio against headline risks, consider an allocation towards alternative investments as well, especially those with proven little to no correlation to market movements during market turmoil, reducing the volatility of your overall portfolio to manage risk exposures for better wealth preservation.

Irrespective of what happens in the White House every four years, there are other more overwhelming challenges to consider. These include global situations like wars, the pandemic, social disorder, monumental debt levels, and economic weakness.

Conclusion

Returns on global stocks depend on multiple factors. The American presidential election and its outcome is just one of the factors.

History has witnessed various other global events like the Asian Financial crisis, the Subprime mortgage crisis, the oil attacks on Saudi Arabia, the Greek Government debt crisis, and Brexit that have had significant impacts on the global economy and financial markets.

A careful study of the impacts of these global events on the markets is a good practice to prepare ourselves to construct an all-weathered portfolio.

Alternatively, it is prudent to consider allocations to investments that are market neutral or absolute return to hedge against “black swan” events that seem to happen more frequently in recent years.

The caveat for 2020, and perhaps 2021 as well, is the COVID-19 pandemic. The unexpected challenges posed by the pandemic have thrown presumptions on market patterns out the window.

With such conditions plaguing the world, managing your portfolio on your own can be particularly challenging. If you’re not working with a financial advisor now, this might be the right time to start

Co-Founder, Chief Executive Officer

Haruhito was the Executive Director of Marcuard Heritage Singapore Pte Ltd, a Swiss multi family office. He was instrumental in building up their European and Asian clientele base which comprised of a global network of asset managers, distribution partners, and legal & tax specialists. Prior to that, he held various positions for 10 years in Deutsche Bank where he gained extensive experience in various Asian markets.

Haruhito has been accredited as a Trust and Estate Practitioner (TEP) by STEP, and as a Financial Industry Certified Professional (FICP) by Singapore’s Institute of Banking and Finance. His vision for Salzworth is to steer it to establish multi-asset class portfolios and funds that seek to achieve steady returns for investors.