2021 November Outlook for G7 Currencies

2021 November Outlook for G7 Currencies

Dollar Currency Index: Bullish above 93.500

The DXY is showing bullish momentum on the daily time frame, as prices continue to hold above both the Ichimoku cloud and ascending trendline support. Stochastics is also approaching the support level at 20.00 where price has reacted at before, adding confirmation to the bullish scenario. We see an opportunity for a potential bounce above 93.500 support area, which is in line with 38.2% Fibonacci retracement and 61.8% Fibonacci extension, towards resistance at 94.500, which is in line with 127.2% Fibonacci extension and horizontal swing high resistance.

DXY Fundamentals

The Dollar underperformed most of its peers in the month of October, eventually steadying around the 93.500 range as the month comes to a close. This comes amid speculations that the U.S. Federal Reserve may not raise interest rates as fast as central banks around the world. U.S. GDP growth was also disappointing, growing only at an annualized 2% in Q3 2021, far below market forecasts of 2.7% and Q2’s growth rate at 6.7%. This was the weakest growth in the pandemic recovery period, as government stimulus begins to wane and surges in COVID-19 cases continued to weigh on the market. Moving forward, we still expect the U.S. Federal Reserve to begin raising interest rates and pulling back on stimulus, which could improve the outlook on the traditional safe-haven Dollar over the coming months. The statement from the FOMC after the meeting and U.S. nonfarm payrolls are key events to watch, as a gauge on the monetary policy direction, as officials continue to attempt balancing slowing growth with rising inflation in the U.S.

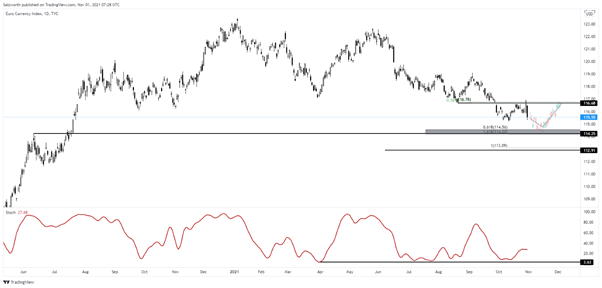

Euro Currency Index: Bullish above 114.30

On the daily timeframe, prices are pushing down towards horizontal pullback support in line with 61.8% Fibonacci extension and 161.8% Fibonacci retracement. Prices could see a bounce from the horizontal pullback support level towards horizontal overlap resistance in line with 38.2% Fibonacci retracement and 100% Fibonacci extension. If prices continue to push downwards, prices might take support at around 112.90 in line with the 100% Fibonacci extension. Stochastics is also showing prices dropping towards 4.26 where we might see a potential bounce.

EUR Fundamentals

Euro tumbled more than 1% to below $1.16 at the end of October as investors digested a slew of economic data including GDP and inflation numbers. Eurozone inflation jumped more than expected to 4.1%, a new 13-year high as compared to market forecasts of 3.7% after the ECB decided to leave monetary policy unchanged and maintain its guidance on interest rates, holding on to the view that higher inflation is temporary and will fade throughout 2022. On the data front, consumer confidence indicator in the Euro Area was confirmed at –4.8 in October, down from –4.0 in the previous month, showing more negative views. Going into November, investors are expecting the ECB to continue providing favourable financing conditions, despite the recent spike in CPI data due to ongoing supply bottlenecks and an unprecedented energy crisis.

British Pound Currency Index: Bearish below 138.40

Pound is showing bearish momentum on the daily timeframe. Prices are testing the 138.35 area in line with 78.6% Fibonacci retracement and 127.2% Fibonacci extension. Prices might continue to push down further towards horizontal swing low support in line with 78.6% Fibonacci extension. If prices break through the descending trendline, prices might face resistance from horizontal swing high resistance in line with 127.2% Fibonacci retracement and 127.2% Fibonacci extension. Prices are holding below the Ichimoku cloud, showing a bearish pressure on prices.

GBP Fundamentals

Sterling outperformed against the dollar, trading at about 1.37, amid expectations that the central bank will be hiking rate this year. Finance Minister Rishi Sunak remarked that the British economy is expected to see growth accelerating faster than expected in 2021. FTSE have been trading sideways as investors digested a batch of Q3 earnings. Yield on UK 10-year government bond bounced back above 1% at the end of October, not far from recent two-year peak of 1.22% amid anxiety over potential interest rate hikes, inflationary pressure and energy crisis happening around the world. As investors head into November, more important economic news includes monetary policy meeting from the Bank of England happening this week as well as CPI data mid-November, with interest rate hikes expected to happen this year.

Australian Dollar Currency Index: Neutral between 74.00 and 75.50

On the daily time frame, prices are holding between the support zone at 74.00 and resistance zone at 75.50 where we maintain a neutral stance. A break above the resistance zone at 75.50 could see further upside to test the next resistance zone at 77.50 in line with the 78.6% Fibonacci retracement and 1.618% Fibonacci extension. Likewise, a break below the 74.00 support zone could see a further downside to test the next support zone at 71.80.

AUD Fundamentals

The Aussie was the best performing currency among its G7 peers, riding on the back of rising commodity prices along with expectations for the RBA to raise interest rates earlier than it initially planned to curb rising inflation threats. The currency extended its rally, amid the strong surge in bond yields, skyrocketing to 0.75% after the Reserve Bank of Australia (RBA) declined to defend its 0.1% target for the key April 2024 bond, stoking bets of an early interest rates hike as traders reckoned the central bank could loosen or quit its yield curve control. While the RBA reiterated commitment to keep interest rates low until 2024, markets are challenging their dovish stance as supply bottlenecks and surging energy prices are causing higher inflation worldwide.

On the data front, Australia’s core inflation rate jumped to a six-year high of 2.1% last quarter, hitting the RBA’s target band of 2-3% two years earlier than policy makers had expected. Meanwhile, the final demand producer price index grew by 1.1% qoq in Q3 2021, following a 0.7% rise in Q2, recording the fifth straight quarter of rise in the index and the highest reading since Q3 2013, supported by strong demand for housing and crude oil shortages. Looking ahead, notable publications to watch include RBA’s monetary policy meeting for signs of pivot from its current dovish stance, along with the unemployment rate and retail sales data as a gauge of the economic recovery.

New Zealand Dollar Currency Index: Bullish above 71.50

On the daily time frame, prices are testing a key support zone at 71.50, in line with the 23.6% Fibonacci retracement where we could see a limited upside to the next resistance zone at 73.00. This area lines up with the 78.6% Fibonacci retracement and keeping in mind the market structure on the weekly time frame, a break and close above this resistance zone is needed to see further upside. Conversely, failure to break above this area could see prices reverse from here. Ichimoku cloud and 13 EMA are showing signs of bullish pressure as well, supporting the bullish bias.

NZD Fundamentals

The New Zealand Dollar rallied higher, supported by RBNZ’s hawkish stance as the central bank raised its cash rate by a quarter of a percentage point to 0.5% in October, the first time in 7 years to tighten the reins on rising inflation. This makes New Zealand one of the first developed countries to reverse the emergency measures put in place to battle the economic impacts of the pandemic. The central bank also indicated plans to remove further stimulus measures over time as the economy continues to recover rapidly, following successful containment of the coronavirus as compared to its peers. On the data front, annual inflation increased to 4.9% in the third quarter of 2021, the highest since the second quarter of 2011 and above forecasts of 4.1%, driven by an increase in housing-related costs, such as construction of new houses and local authority rates. This is also the highest surge in 10 years in the third quarter, stoking market wagers that the central bank will keep raising interest rates.

Elsewhere, imports rose 30.5% from a year earlier to a fresh all-time high of NZD 6,567 million in September of 2021, the third successive month of record imports. The growth was attributed to the rise in vehicles, parts, and accessories, up NZD 269 million (43 percent) to NZD 895 million. On the other hand, exports grew 9.6% from a year earlier following a sharp 17% rise in sales of milk powder, butter, cheese and crude oil. Looking ahead, notable publications to watch include the unemployment rate, retail sales, inflation data and RBNZ’s monetary policy meeting at the end of November.

Canadian Dollar Currency Index: Bullish above 80.20

On the daily time frame, prices broke above the previous resistance-turned-support zone at 80.20 which coincides with the 23.6% Fibonacci retracement and 100% Fibonacci extension. A further upside could be seen above this support zone to the next resistance zone target at 82.00, in line with the 1.618% and 78.6% Fibonacci retracement. The 34 EMA and MACD supports the bullish bias as well.

CAD Fundamentals

The Canadian Dollar extended its rally in October, buoyed by rising oil prices as the global energy crunch deepens. Despite the slight retreat in WTI crude futures to around $83.2 per barrel following news of China’s release of gasoline and diesel reserves to increase market supply and support price stability, oil prices stand near a 7-year high. The OPEC meeting on 4 November will be closely watched for any increase in production output as traders reckoned the group will stick to its plan to add 400,000 barrels per day in December. On the data front, the Canadian economy rose 0.4% in August, led by increases in accommodation and food services, retail trade and transportation, as easing of public health restrictions and reopening across the country supported the growth.

Meanwhile, Canada’s 10-year government bond yield surged to a level not seen since January 2020, hitting 1.7% in the last week of October, on the back of a hawkish BoC as the central bank signalled interest rates hikes as soon as April 2022 and ended its quantitative easing program. Growth forecasts were also revised lower for both 2021 and 2022 along with higher inflation expectations caused by higher energy prices and persistent supply bottlenecks. Canada’s economy is now expected to grow at a slower 5.1% this year, down from the 6% in the July forecasts, while 2022 growth forecasts were revised lower from 4.6% to 4.25%. CPI inflation will likely remain elevated into next year, and ease back to around the 2% target by late 2022. Looking ahead, the Canadian Dollar could extend its rally, supported by rising commodity prices on the assumption that OPEC will keep its supply tight. Other notable publications include the unemployment rate, CPI, core retail sales and GDP data.

Japanese Yen Currency Index: Bearish below 89.20

On the daily timeframe, the Japanese Yen is showing bearish momentum, as it continues to hold below the moving average resistance. We see a potential bearish reversal at 89.20, which is in line with horizontal pullback resistance and moving average resistance, towards the next major support level at 87.50, in line with 61.8% Fibonacci extension and horizontal swing low support.

JPY Fundamentals

The Yen underperformed in the month of October, as it continued to drop to the 87.50 support level. This comes after the Bank of Japan (BoJ) chose to maintain its dovish stance at the October meeting, keeping short-term interest rates low at –0.1% and 10-year government bond yields at 0% in line with general consensus. Bearish sentiment is also expected to continue persisting as the BoJ revised down its expectations of GDP growth for the current financial year to 3.4%, from the previous 3.8%, citing sluggish consumption and supply disruptions as reasons for poorer expectations. Inflation rate was also revised downwards to 0% from 0.6%. Going forward, we expect the Japanese Yen to remain bearish as BoJ maintains its dovish stance.