2022 May Outlook for G7 Currencies

2022 May Outlook for G7 Currencies

Dollar, Euro and Pound

Bullish outlook for Dollar: Dollar reached a new 20-year high at the 104 level, as investors continued to bet on further tightening of monetary policy by the Federal Reserve to tackle strong inflationary pressures and slowing economic growth going forward. As such, the dollar as a safe-haven asset continues to be attractive to most investors in such uncertain times. In the latest Fed meeting, the Federal Reserve hiked its benchmark funds rates by 50 basis points while latest nonfarm payrolls data reflected a strong performance in the U.S. jobs market. As a result, futures markets are pricing in a 75-basis point hike by the end of the year, further reinforcing the bullish outlook for the U.S. dollar going forward in the month of May.

Regional uncertainties continue to pressure ECB: Euro continues to suffer against the much stronger greenback, falling to lows not seen since 2016 at the 1.05 level. Uncertainties in the region continue to persist given the ongoing Russian-Ukrainian crisis, as well as the possibility of facing stagflation. Furthermore, the ECB is expected to lag behind the Federal Reserve in tightening monetary policy further going forward, which reduces the attractiveness of the Euro. Moving forward, given the poor economic outlook, the risk-on Euro is expected to continue underperforming against its peers, as investors continue to watch out for any possible signs of more aggressive rate hikes from the ECB.

Inflationary pressures and growth risks in the U.K.: Sterling also similarly underperformed against the stronger U.S. dollar, reaching a 2-year low of $1.22 near the start of May. This comes even after the BOE raised key interest rates for the fourth consecutive time in May, in line with general market expectations. However, general market consensus remains for the BOE to take after the Federal Reserve in terms of how aggressive monetary policy tightening will be. Furthermore, the BOE expects a nearly 1% fall in GDP in the final quarter of 2022, signalling a poor outlook for economic growth in the U.K. and adding onto the bearish tone for the Pound moving forward. As such, the Pound is expected to weaken in line with other more risk-on currencies amidst such global uncertainties, where safe-haven assets like the Dollar are expected to benefit.

EURUSD: Bearish below 1.0800

| S1 | S2 | R1 | R2 |

| 1.0300 | – | 1.0800 | 1.1150 |

GBPUSD: Bearish below 1.2650

| S1 | S2 | R1 | R2 |

| 1.2000 | – | 1.2650 | 1.3000 |

Commodity Currencies

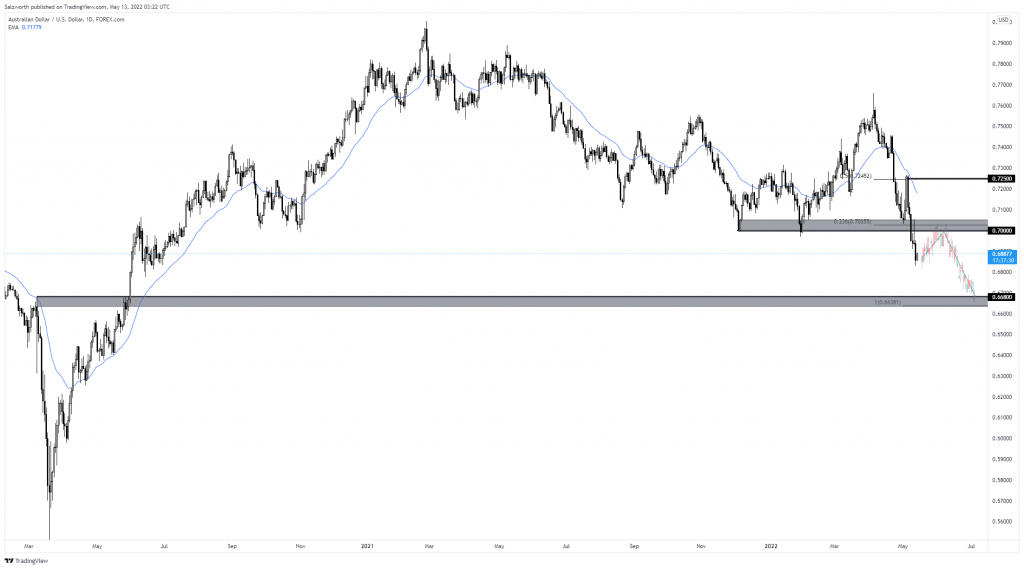

Hawkish RBA did not support the currency: The Australian dollar fell to its lowest level in nearly two years, as fears of a global economic downturn weighed on commodity-linked currencies, while higher-than-expected US inflation data bolstered bets on faster Fed tightening. In an effort to contain rising prices, the US central bank is perceived as leading a worldwide monetary tightening cycle. Despite a surprisingly hawkish shift from the Reserve Bank of Australia, which started its cycle of interest rate hikes with a larger-than-expected 25 basis-point raise on May 3, the Aussie extended its decline. RBA recently upped its core inflation projection, with no return to its 2-3 percent target range expected until 2024, even in the event of a succession of rate hikes. Markets expect another quarter-point hike to 0.6 percent in June, followed by monthly increases to almost 3% by year’s end. Looking ahead, downside risks in the Aussie could continue to dominate in the short term as events in Europe and China continue to roil global markets.

Further tightening ahead for the RBNZ: The New Zealand dollar plummeted to its lowest level in nearly two years as risk aversion seen in the markets weighed on commodity-linked currencies, while higher-than-expected US inflation data boosted expectations for a stronger Dollar with more aggressive Federal Reserve tightening. A Reserve Bank of New Zealand survey found that businesses expect annual inflation to rise to 4.9 percent in the second quarter of 2022, up from 4.4 percent in the previous survey. To rein in inflation, the RBNZ has lifted the benchmark rate four times in a row since it began tightening last year. Bond futures suggest that the central bank will raise its 1.5 percent cash rate by half a percentage point at its policy meeting on May 25. Looking ahead, Kiwi could extend its decline in the short term as the risk-sensitive currency remains at the mercy of the recent markets sell-off.

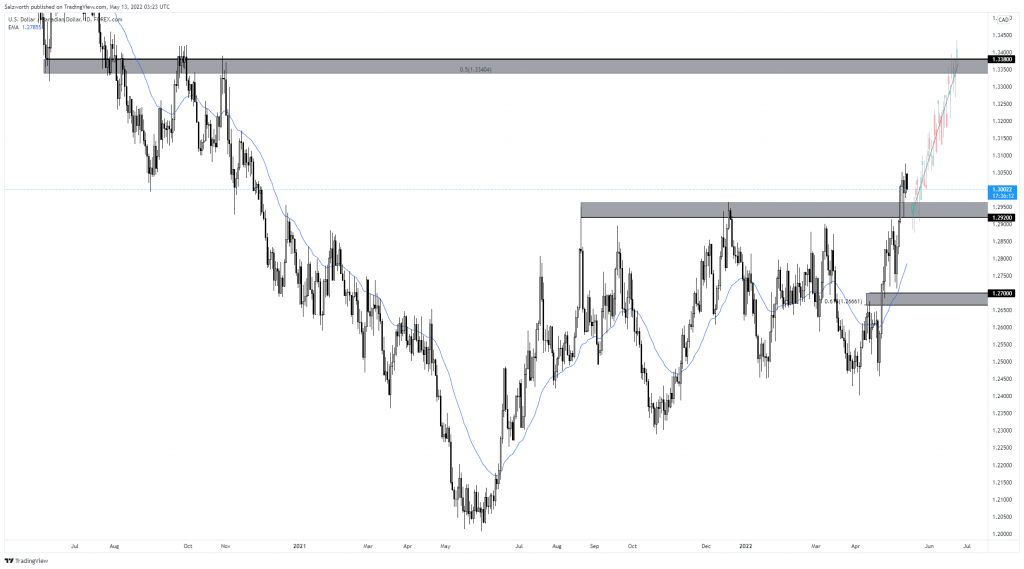

Canada grapples with soaring inflation and a tight labour market: The Canadian currency was trading at approximately 1.3 against the greenback, its lowest level since November 2020, amid widespread dollar strength following a stronger-than-expected US inflation print in April, which bolstered prospects of further Fed tightening. In Canada, the Bank of Canada is anticipated to maintain its hawkish posture, as the labour market tightens with unemployment at a historic low of 5.2 percent in April and annual inflation at a three-decade high of 6.7 percent in March.

Oil prices struggle for further upside: Oil prices continue to trade sideways, struggling for further upside after retreating from its recent March’s high. We could see the downside risks persist in the near-term as China continue to ratchet up Covid control measures in line with their zero-covid policy, which could pose a threat to demand. Meanwhile, the EU’s proposed oil embargo against Russia has made little headway at the European Commission and other member states have been unable to persuade Hungary’s government to support the ban. The Hungarians have stated that they will only accept the embargo if Russian pipeline oil flows are exempted. Given that the Druzhba pipeline flows account for nearly half the amount of crude oil that the EU imported from Russia in 2021, an exception on pipeline flows is unlikely. If the talks linger on, a ban on a national level could be enforced instead. There is the possibility of future demand downgrades from the OPEC, considering their more modest downward revisions so far.

AUDUSD: : Bearish below 0.7000

| S1 | S2 | R1 | R2 |

| 0.6680 | – | 0.7000 | 0.7250 |

NZDUSD: Limited downside below 0.6550

| S1 | S2 | R1 | R2 |

| 0.6150 | – | 0.6550 | 0.6750 |

USDCAD: Bullish above 1.2920

| S1 | S2 | R1 | R2 |

| 1.2920 | 1.2700 | 1.3380 | – |