2022 August Outlook for G7 Currencies

2022 August Outlook for G7 Currencies

Dollar, Euro and Pound

Dollar pared recent gains as Fed tempered guidance

The Dollar index retreated after hitting its 20-year high of 109, with demand weighed down by recession fears and poor business sentiments. Less aggressive rate hikes of 75 bps instead of the expected 100 bps were announced last Thursday in the July FOMC meeting, despite higher-than-expected annual inflation rate for June which stood at 9.1%, ahead of the market estimates of 8.8%. On the data front, US GDP for the second quarter came in at -0.9%, adding on to the recession concerns with Fed Chair Powell’s repeated emphasis on reining in inflation even at the expense of growth. Meanwhile, unemployment in the US maintained at 3.6%, signalling a resilient labour market, while the US ISM Manufacturing Index fell to its lowest of 52.8 since June 2020 in face of softer demand. Looking forward, the Dollar is still expected to remain strong, with the effects of the rate hikes kicking in.

Economic outlook remains grim in the Eurozone

Euro extended its decline against the greenback, hitting a 20-year low and briefly dipping below parity against the US Dollar. The economic outlook on Eurozone remains grim as the region faces stagflation risks with rising price pressures and slower economic growth. While a hawkish ECB could provide support the currency as the central bank seek to rein in supply-driven inflation which stood at a record high of 8.9% in July, exacerbated by the energy crisis and Russian oil bans, soft economic data continue to limit the currency’s upside. In its July’s monetary policy meeting, the ECB increased its benchmark deposit rate by 50 basis points up from 0%, exceeding a widely anticipated 25 basis point hike, marking the first interest rate hike by ECB in eleven years. This provided limited support for the Euro which pared gains after following a slew of disappointing PMI data signalling contraction in the Eurozone. Germany recorded the greatest decline in more than 2 years and France experiencing the worst pace of expansion in 16 months, leading to poor consumer sentiment and recessionary fears that could contribute to further decline in growth. Going forward, ECB is expected to take on a more aggressive stance, with 50 bps of interest rate hikes for both September and October to tackle the soaring inflation.

UK’s resilient economy bolster case for more aggressive hikes by the BOE

Sterling suffered against the greenback, fuelled by political instability and rising energy prices, with rising inflation that hit a 4 decade high of 9.4% year on year in June. Investors expect the Bank of England to join the global trend of aggressive tightening of their monetary policy, with expectations of the largest rate hike in 27 years of 50 basis points in the August meeting. On the other hand, July PMI data signalled expansion in the manufacturing and services sectors which bolstered the case for more aggressive tightening by the BOE to curb inflation while the economy remains resilient to rising rates. Looking forward, Sterling could see further downside against the greenback until implementation of more aggressive rate hikes.

EURUSD: Bearish below 1.0380

| S1 | S2 | R1 | R2 |

| 1.0000 | – | 1.0380 | 1.0780 |

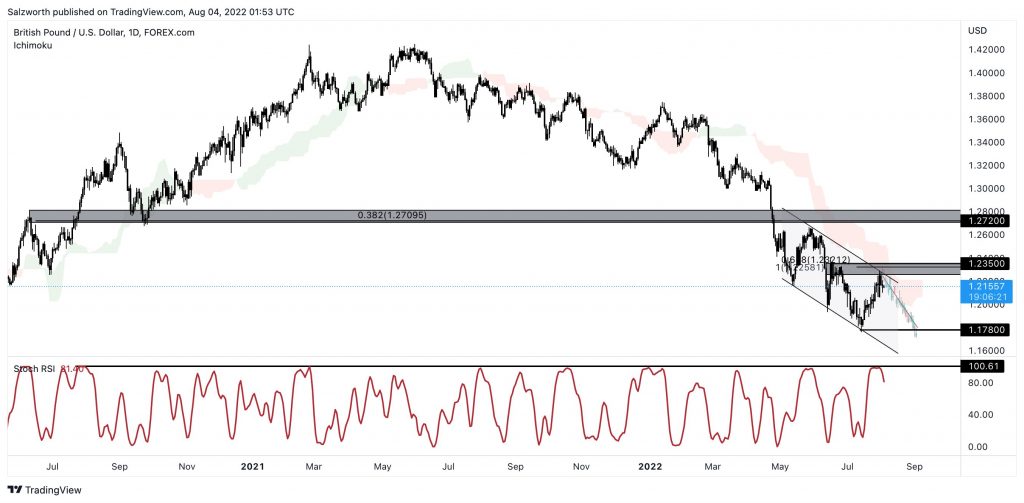

GBPUSD: Bearish below 1.2350

| S1 | S2 | R1 | R2 |

| 1.1780 | – | 1.2350 | 1.2720 |

Commodity Currencies

Second quarter’s inflation eased in Australia

Aussie benefited from the recent Dollar’s decline while a hawkish RBA also buoyed demand for the currency. Reserve Bank of Australia increased interest rates for the fourth consecutive month but scaled back on guidance of future hikes amid expectations of an economic downturn. As anticipated, the RBA increased its cash rate by 50 basis points to 1.85%. RBA Governor Philip Lowe added that although the process of normalizing monetary conditions is not on a set course, the board “expects to take more steps in the process over the months ahead.” This contrasted with his earlier statements that the central bank wanted interest rates to be at least 2.5% below “neutral.” The RBA also anticipated that consumer price inflation would reach a peak of 7.75% in 2022. Meanwhile, Q2 CPI inflation data also eased recording a 1.8% increase, short of 1.9% market estimates which helped to ease pressure on the RBA for more aggressive tightening ahead.

Kiwi remains vulnerable to fragile market risk sentiment

Kiwi Dollar hovered below $0.63 as mixed domestic jobs data alongside hawkish comments from US Federal Reserve members weighed on the currency. The unemployment rate in New Zealand increased by 0.1 percentage points to 3.3% in the second quarter of 2022, up from a record low of 3.2% in the first quarter. The survey also revealed a further acceleration in annual pay growth, which reached 3.4%, the strongest rate since 2008. In the upcoming RBNZ’s monetary policy meeting on August 17, markets are anticipating a further 50 basis point rate hike to tackle rising inflation which rose ahead of expectations to reach a fresh 32-year high. Annual inflation rose to 7.3% in the second quarter, up from 6.9% in the first quarter. However, the currency remains vulnerable to the macroeconomic backdrop and fragile market risk sentiment which could negate hawkish moves by the RBNZ.

Hawkish BOC fuelled the Loonie’s rally

BOC surprised markets by raising its benchmark rate by 100 basis points in July’s meeting which provided support for the Loonie against the greenback. Elsewhere, oil prices held steady near $91 per barrel after retreating from its recent high as traders weigh easing supply constraints against a softer demand outlook. Latest oil inventories data recorded an unexpected increase in US crude oil inventories which eased rising price pressures. OPEC+ also decided to increase its objective for oil output by 100,000 barrels per day (bpd), or around 0.1% of world oil demand.

AUDUSD: : Bearish below 0.7050

| S1 | S2 | R1 | R2 |

| 0.6680 | – | 0.7050 | 0.7250 |

NZDUSD: Bearish below 0.6380

| S1 | S2 | R1 | R2 |

| 0.6100 | – | 0.6380 | 0.6550 |

USDCAD: Bearish below 1.2950

| S1 | S2 | R1 | R2 |

| 1.2650 | – | 1.2950 | 1.3120 |