2022 July Outlook for G7 Currencies

2022 July Outlook for G7 Currencies

Dollar, Euro and Pound

Dollar remains supported as inflation showed no signs of easing

The Dollar index rallied to a fresh 20-year highs of 109 on Friday, as recession fears, safe-haven inflows and prospects of higher interest rates continue to buoy demand for the greenback. On the data front, robust US jobs reports which eased slowdown fears and bolstered Fed’s aggressive stance in tightening its monetary policy to curb rising inflation also underpinned the Dollar’s strength. On the other hand, the labour market remained resilient as the US unemployment rate met expectations of 3.6 percent in June of 2022, the lowest reading since February 2020 while the US economy added 372K payrolls in June of 2022, ahead of market forecasts of 268K. Demand for the safe-haven currency was further boosted with hawkish comments by Raphael Bostic who indicated support for another rate hike of 75 basis points this month. He is the president of the Atlanta Fed Bank, who had previously been one of the central bank’s most dovish policymakers. Elsewhere, US annual inflation rate climbed to 9.1% in June 2022, ahead of market estimates of 8.8%, stoking bets of faster and larger Fed rate hikes ahead to rein in inflation. US Retail Sales data pointed to robust consumer spending, with a 1% increase in June, above expectations of a 0.8 % increase. Looking ahead, the Dollar’s strength should remain supported by economic data and a hawkish Fed.

Eurozone facing stagflation risks

Slowdown concerns and a wider gap between the ECB and the Fed left the Euro battered near its 20-year lows as it tried to maintain parity with the Dollar. Supply-driven inflation in Europe, with its heavy reliance on Russia’s energy imports accounting for an estimated 40% of its gas supplies makes it vulnerable to stagflation risks. This could further exacerbate the growth risks and put the ECB in a bind when it comes to raising interest rates to curb soaring inflation. The Euro could face strong headwinds on concerns that the elevated energy prices, exacerbated by the annual maintenance of the Nord Stream key pipeline, the biggest single pipeline carrying Russian gas to Germany could drive the region into a deep recession. Notable publications include Germany’s preliminary CPI data which eased to 0.1%, lower than estimates of 0.4% as the government’s relief energy package helped eased price pressures. However, effects are likely temporary with the package ending in August, alongside price pressures which continue to climb in food and service sectors.

Sterling remains unattractive with diverging monetary policy and political uncertainty

British Pound sank to its lowest level in more than two years weighed down by political uncertainty and entrenched inflation. The UK’s ruling Conservative Party began its search for the next prime minister and five candidates are currently in the running. Elsewhere, despite the BoE hiking rates five times since December, and rates standing at 13 years high of 1.25%, inflation continue to climb and undermine growth leaving the BoE less room to manoeuvre.

EURUSD: Bearish below 1.0400

| S1 | S2 | R1 | R2 |

| 0.9980 | – | 1.0400 | 1.0650 |

GBPUSD: Bearish below 1.2200

| S1 | S2 | R1 | R2 |

| 1.1780 | – | 1.2200 | 1.2480 |

Commodity Currencies

Aussie remains vulnerable to global risk dynamics

Commodity currencies edged lower against the greenback, weighed down by recession fears and China’s new virus lockdown restrictions which dominated the market sentiment. In Australia, the RBA hiked interest rates by 50 basis points, as many had anticipated, and declined to provide the more hawkish forward guidance that some had hoped for. Robust jobs report in Australia signalled a tight labour market and economic resilience to rising interest rates which could pave way for more aggressive rate hikes by the RBA to curb inflation. The recent data showed Australian employment surged 88,400 in June, surpassing forecasts of a 30,000 increase, while the unemployment rate dived to a 48-year low of 3.5%. The currency remains vulnerable to market risk sentiment and developments in China which could prompt widespread lockdowns following the omicron subvariant spread.

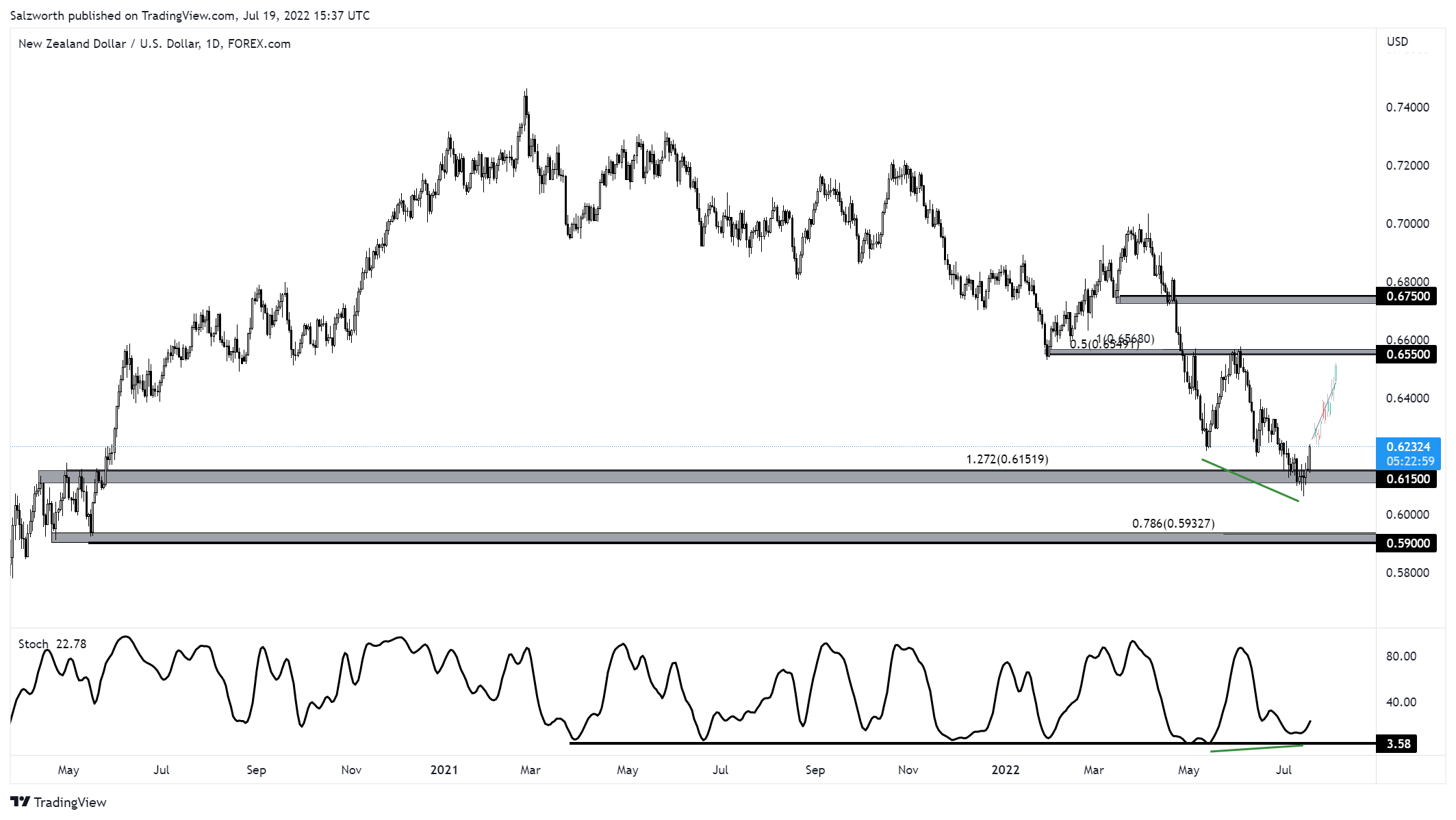

Inflation data could underpin more aggressive moves by RBNZ

In New Zealand, Reserve Bank of New Zealand increased its cash rate by 50 basis points to 2.5 percent, a move that was widely anticipated, and the New Zealand currency held stable around $0.6200. RBNZ announced that it would “continue to tighten monetary conditions at pace to ensure price stability and support maximum sustainable employment” after that sixth consecutive rate increase, with another 50-bps rate hike also anticipated by economists for August. Higher-than-expected inflation data could also underpin more aggressive hikes as New Zealand’s inflation accelerated to 7.3% from 6.9% in the first quarter, ahead of 7.1% forecast while consumer prices advanced 1.7% from three months earlier, exceeding the 1.5% median estimate.

Oil prices retreated as supply concerns eased amid demand woes

Lonnie depreciated against the greenback despite a 100-bps rate hike by the BOC which exceeded market’s expectations of a 75bps hike. Elsewhere, WTI crude prices retreated, weighed down by recession concerns and new coronavirus-induced lockdowns in top importer China. Growing viral infections across China and the identification of a novel Omicron subvariant in Shanghai stoked concerns about the possibility of wider lockdowns across the nation. Meanwhile, supply concerns eased as US energy envoy Amos Hochstein expressed optimism that major Middle Eastern producers have spare capacity and are expected to increase supplies. Moreover, the recently appointed head of Libya’s National Oil Corp. also declared that the nation’s oil output will resume from all closed fields and ports.

AUDUSD: : Bearish below 0.7050

| S1 | S2 | R1 | R2 |

| 0.6680 | – | 0.7050 | 0.7250 |

NZDUSD: Limited upside above 0.6150

| S1 | S2 | R1 | R2 |

| 0.6150 | 0.5900 | 0.6550 | 0.6750 |

USDCAD: Bearish below 1.2850

| S1 | S2 | R1 | R2 |

| 1.2850 | 1.2650 | 1.2980 | – |